Massachusetts paycheck tax calculator

If you make 192331 a year living in the region of Massachusetts USA you will be taxed 47753. Although payroll accountants and payroll software can take care of your Massachusetts payroll for you well let you know the details in case you want to have a go at it yourself.

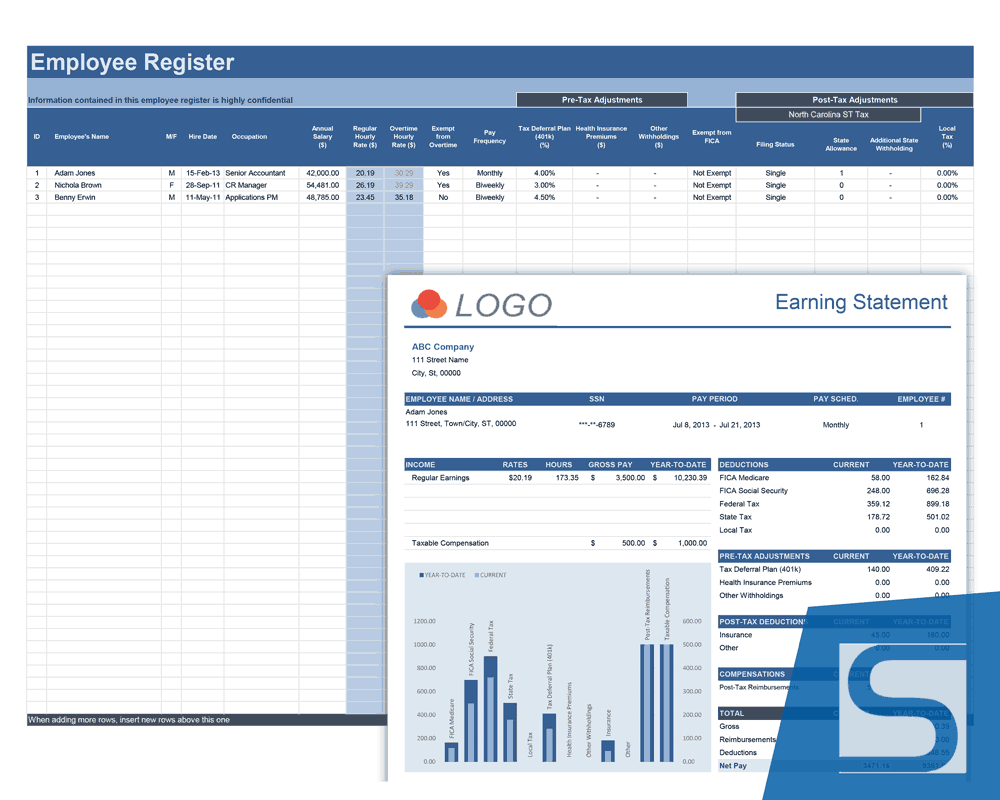

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

Our income tax and paycheck calculator can help you understand your take home pay.

. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Massachusetts Hourly Paycheck Calculator. Massachusetts Hourly Paycheck Calculator Results.

Massachusetts Income Tax Calculator Calculate your federal Massachusetts income taxes Updated for 2022 tax year on Aug 31 2022. This marginal tax rate. Ad Compare This Years Top 5 Free Payroll Software.

The Massachusetts Income Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year. The Massachusetts income tax rate. Your average tax rate is 1994 and your.

The Federal or IRS Taxes Are Listed. After a few seconds you will be provided with a full. The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income.

You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide. The amount of federal and Massachusetts income tax withheld for the prior year.

Ad Payroll So Easy You Can Set It Up Run It Yourself. The results are broken up into three sections. Below are your Massachusetts salary paycheck results.

The states tax revenue per capita was 4005. Free Unbiased Reviews Top Picks. New employers pay 242 and new.

Select Region United States. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Use ADPs Massachusetts Paycheck.

Ad Compare This Years Top 5 Free Payroll Software. The total Social Security and Medicare taxes withheld. The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with.

Just enter the wages tax withholdings and other information. 2022 tax rates for federal state. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

Our team members work to cultivate a unique corporate culture rooted in inclusion strength and togetherness. Massachusetts Sales Tax Calculator. On the other hand.

All Services Backed by Tax Guarantee. Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Free Unbiased Reviews Top Picks. Your average tax rate is 1198 and your marginal tax rate is 22. Paycheck Results is your.

Massachusetts Income Tax Calculator 2021. 15 Tax Calculators 15 Tax. So the tax year 2022 will start from July 01 2021 to June 30 2022.

To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. Income Tax Calculator 2021 Massachusetts 143831.

On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437. The calculator will show you. Ratings for Massachusetts Paycheck Calculator.

Contacting the Department of.

How To Calculate Income Tax In Excel

Here S How Much Money You Take Home From A 75 000 Salary

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

State Income Tax Rates Highest Lowest 2021 Changes

Tax Calculator Estimate Your Income Tax For 2022 Free

Massachusetts Paycheck Calculator Smartasset

How To Calculate Net Pay Step By Step Example

Massachusetts Paycheck Calculator Smartasset

Payroll Calculator Free Employee Payroll Template For Excel

Pin Page

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Monthly Take Home Pay From A 100k Annual Salary Vivid Maps Map Salary Personal Financial Planning

North Carolina Usa Map North Carolina Usa North Carolina Goldsboro North Carolina

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income